Providing lifetime retirement income plans can help employers in the Marathon for Talent

CAAT Pension Plan releases white paper on the business benefits of better pensions

TORONTO, Nov. 30, 2023 /CNW/ – CAAT Pension Plan today released a white paper, titled Better Pensions Needed to Create a Better Canada, on current demographic trends and state of retirement preparedness that open opportunities for businesses to better retain and engage their workforce. Providing an employer perspective to retirement literacy research, the report highlights actionable recommendations to better attract and retain talent in an intensifying labour market.

The paper examines results from the Canadian Public Pension Leadership Council (CPPLC) survey report released in June 2023, The Pensions Canadians Want: Perceptions of Retirement (2016–2022), which compared changes in Canadians’ views on retirement over the past six years. It traced how outlooks have declined, factoring environmental and economic drivers such as pandemic disruptions and rising inflation.

“After years of challenging economic conditions, many have been set back in their savings and are more stressed about their financial and retirement futures,” said Derek Dobson, CEO and Plan Manager of CAAT Pension Plan. “The paper highlights the pivotal role employers play in improving retirement income security for Canadians where savings vehicles can have the most positive impact, which is in the workplace.”

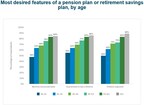

More than half of Canadians in Generation X (53%) are highly stressed about outliving their retirement savings, followed by younger workers of Millennials and Generation Z between ages 25 to 34 (49%).The majority of Canadians under 45 (55%) want an employer contribution match.Canadians across all age groups want retirement income that is guaranteed to last a lifetime (72%), inflation-adjusted (71%), and monthly and predictable (71%). The desire for the features increases as workers near retirement age.

Organizations that offer lifetime retirement income plans can support the long-term financial wellness of employees and gain a competitive edge in attracting and retaining top-tiered talent. While the qualities of defined benefit pensions are most desirable, more than half of Canadians ages 18 to 24 (55%) would switch employers for any pension plan at all.

Retirees with adequate lifetime retirement income retain purchasing power and spend in their communities and at local businesses. The report captures the downstream benefits of retirement income security in Canada, based on previous CPPLC economic studies that connects every $10 in public pension benefit paid to $16.72 in generated economic benefit.

To read the study, please visit: www.caatpension.ca/CAAT/Assets/Documents/News/Announcements/CAAT_Report_Based_on_CPPLC_Data-November-2023.pdf

Established in 1967, the CAAT Pension Plan is an independent, jointly governed plan that offers two highly desirable designs of a defined benefit pension. CAAT’s award-winning DBplus plan design is leading an extraordinary pace of growth for the Plan. Originally created to support the Ontario college system, the CAAT Plan now proudly serves more than 360 participating employers in 17 industries including the for-profit, non-profit, and broader public sectors. It currently has more than 91,700 active and retired members. The CAAT Plan is respected for its pension and investment management expertise and focus on stability and benefit security. On January 1, 2023, the Plan was 124% funded on a going-concern basis.

Learn more at: www.caatpension.ca.

SOURCE CAAT Pension Plan