Former IRS Boss Maximizes Tax Savings from Charitable Giving Using Optimized Charitable Trust Strategy

SCOTTSDALE, Ariz., Dec. 27, 2023 /PRNewswire/ — With less than a week to take action before year’s end, high income Americans should look to former IRS commissioner John Koskinen—dubbed the country’s “Mr. Fix-It”—for tax savings and philanthropic solutions, according to an article published today in Fortune.

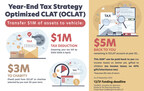

In the article, charitable trust attorney Jonathon Morrison reveals how Koskinen was decades ahead of his time in executing an optimized variant of a charitable lead annuity trust (CLAT) that funded numerous athletic scholarships and a 4,500-seat stadium at Duke University (his alma mater) while ultimately returning a lump sum to his children, tax-free. In addition to his time at the IRS, Koskinen’s career spanned federal judge clerkship and law practice, enterprise turnaround, and political appointments under Presidents Obama, Bush, and Clinton—and he asserts he would “without a doubt” choose the same CLAT strategy again today. “There are always uncertainties in the economy, but in America there’s usually another boom around the corner. Now is a good time to invest—especially with the assurance of a CLAT,” Koskinen said, in Fortune.

“It wasn’t a surprise to learn that Koskinen’s CLAT was already optimized, albeit predating the mainstream use of the “Optimized CLAT” for income tax planning by 20 years,” Morrison remarked. “Commissioner Koskinen understands the workings of the Tax Code as well as anyone, and he recognized that an Optimized CLAT was the best way to prioritize philanthropic influence, provide a significant future gift to his family, and simultaneously minimize income taxes and future estate taxes.”

In Morrison’s peer-reviewed cover article in Estate Planning, favorable rulings and regulations over the past 50 years earned the CLAT its title as the most opportune IRS-approved income tax deduction vehicle available for the working rich, the ultra-wealthy, and individuals experiencing a significant capital event. Morrison details how the Optimized CLAT (OCLAT) pushes the “regular CLAT chassis” as far as IRS caselaw permits, thereby maximizing the contributor’s tax and financial benefits. The OCLAT can also be repurposed as a year-end tax deduction strategy that delivers four key benefits to “outperform nearly all other traditional investment vehicles”:

The contributor benefits from a 30% dollar-for-dollar tax deduction in the funding year (providing immediate tax savings), subject to a large funding cap (30% AGI without phaseout);The OCLAT returns an expected 2-5x the initial contribution amount back to its contributor after significant donations to charity are made over a term of years;OCLAT assets may be gifted to children or heirs without the 40% federal gift/inheritance tax; andOCLAT assets are exempt from the contributor’s personal creditors.

Koskinen’s philanthropic achievements using a CLAT epitomized its potential for estate growth and humanitarian impact, especially in rocky financial times. “The best investment advice has been buy and hold,” Koskinen advises in the article. “Even during the recession of 2007, it was the people who sold when times were tough who I worried about most.” A properly executed OCLAT offers its contributor this hard-earned wisdom with immediate results; it must be funded by December 31 to receive a 2023 income tax deduction.

How a former IRS boss optimizes his charitable trust to support his alma matter–and give assets to his children tax-free reveals in-depth tax planning strategies and recommendations for wealth advisors, chief investment officers, CPAs, entrepreneurs, and high earning income Americans.

Visit Jonathon Morrison at Frazer Ryan Goldberg & Arnold LLP at www.frgalaw.com/attorneys/morrison to learn more, and to discover OCLAT research, FAQs, and tax planning materials.

Follow Jonathon on LinkedIn at www.linkedin.com/in/jonathonmorrison

Segments of this article originally appeared on Fortune.com: https://fortune.com/2023/12/27/former-irs-boss-optimizes-charitable-trust-to-support-alma-mater-give-assets-children-tax-free-succession-tax-jonathon-morrison/.

About Jonathon M. Morrison

A senior partner at Frazer Ryan Goldberg & Arnold, Forbes Finance contributor, and Best Lawyers honoree, Jonathon Morrison‘s practice is focused on tax, business and estate planning for clients with large or complex estates. He is licensed in both Arizona and California and is a Certified Specialist in Estate Planning, Trust and Probate Law in California.

After a decade practicing with preeminent estate planning law firms in Silicon Valley, Jonathon gained a mastery of modern, advanced estate and tax planning strategies. With his unique background, Jonathon enjoys a reputation for developing advanced estate planning solutions for high income and high net worth clients whose objectives include income tax and estate tax minimization, charitable and philanthropic giving, business exit and succession planning, and asset protection.

Jonathon is also a frequent speaker and nationally recognized authority with respect to a specific type of charitable vehicle: the optimized charitable lead annuity trust (OCLAT). Jonathon is frequently engaged by clients, advisors and attorneys around the country to implement and provide advice with respect to OCLAT planning.

About Frazer Ryan Goldberg & Arnold LLP

Frazer Ryan Goldberg & Arnold is a nationally recognized boutique law firm strategically structured to satisfy the unique needs and high expectations of individuals, families, and closely held businesses. For more than 30 years, Frazer Ryan Goldberg & Arnold has maintained its reputation as the premier tax and estate planning law firm in Arizona.

Widely respected for its dedication to “private client” matters, Frazer Ryan’s 26 skilled and innovative attorneys including more than a dozen tax and estate planners, five dedicated trust/estate litigators, and four dedicated tax litigators (including former IRS trial attorneys) are organized as service-specific teams that provide peer-recognized insight, depth, and skill in the firm’s six core areas: Estate Planning, Tax Controversy, Trust and Estate Controversies, Business and Corporate Law, and Elder Law.

Consistently ranked by statewide publications as a Top 3 Tax and Estate Planning law firm, Frazer Ryan is one of only 50 companies selected for the 2023 edition of Arizona’s Most Admired Companies, a business-excellence recognition program co-sponsored by Arizona Business magazine. In 2022, US World News and Report named Frazer Ryan as a Regional Tier 1 law firm in Trust & Estate Law, Tax Litigation, and Trust & Estate Litigation. Thirteen of the firm’s attorneys have been recognized as The Best Lawyers in America.

Frazer Ryan Goldberg & Arnold LLP

Contact: Christopher Wells MBA

Email: [email protected]

www.frgalaw.com

1850 N. Central Ave, Suite 1800, Phoenix, AZ 85004

View original content to download multimedia:https://www.prnewswire.com/news-releases/former-irs-boss-maximizes-tax-savings-from-charitable-giving-using-optimized-charitable-trust-strategy-302022889.html

SOURCE Frazer Ryan Goldberg & Arnold