Continued Focus on Optimising Margins Across the Value Chain Underpins Solid Performance for Golden Agri

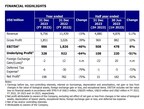

Second half 2023 EBITDA grew by six per cent compared to first half 2023, resulting in full-year EBITDA of US$986 million and a healthy margin of 10 per centProposed final dividend of 0.613 Singapore cents per share for full year 2023 profit, subject to shareholder approval

SINGAPORE, Feb. 28, 2024 /PRNewswire/ — Golden Agri-Resources Ltd (“GAR” or the “Company”) announced a solid financial performance for 2023, marking a normalisation following record-high CPO prices in 2022.

On the results, Mr. Franky O. Widjaja, GAR Chairman and Chief Executive Officer commented: “The Board is pleased to see GAR’s accomplishments in 2023, buoyed by strong upstream and consistent downstream performance. This continuing success highlights the resilience of our advanced integrated business model, which has laid a solid foundation for the Company. By capitalising on technological advancements and a steadfast commitment to sustainability, GAR is poised to further enhance its competitive edge across its business value chain. These endeavours will enable GAR to sustain long-term growth and bolster its position to navigate the evolving industry landscape.”

Revenue for 2023 decreased by 15 per cent year on year to US$9.76 billion, in line with lower CPO prices compared to the previous year, though this was partly offset by higher sales volume. EBITDA for the year stood at US$986 million or a healthy 10 per cent margin, while underlying profit and net profit for the year were US$328 million and US$198 million, respectively.

Elaborating on the outlook for the industry, Mr. Widjaja said: “Palm oil supply in 2024 is expected to be constrained as a result of El Niño conditions that brought water deficit in some areas in the third quarter of 2023. Combined with low seasonal production in the first half of the year, palm oil is currently trading at a premium to other vegetable oils. Nonetheless, we see sustained demand for palm oil thanks to increased market appreciation for its versatile applications. Demand will continue to be robust especially from consumption as a food staple, as well as increasing usage in biodiesel and biomass alternatives. While we maintain an optimistic long-term outlook for the palm oil industry, we remain cautious of uncertainties stemming from ongoing geopolitical tensions and volatility in the global economic landscape.”

With careful consideration for rewarding shareholders whilst maintaining a strong balance sheet ahead of anticipated global challenges, the Board proposes a final dividend of 0.613 Singapore cents per share or approximately US$59 million in total, representing 18 per cent of underlying profit. The proposed final dividend will be distributed on 16 May 2024, subject to approval from GAR’s shareholders at the 2024 Annual Meeting.

SEGMENTAL PERFORMANCE

Plantations and palm oil mills

GAR’s planted area, including plasma, totaled 532 thousand hectares, of which 92 per cent was mature at the end of 2023. Despite the El Niño conditions, GAR successfully replanted 14,200 hectares of old estates with higher-yielding, next-generation planting materials in 2023, maintaining an average plantation age of 16 years. This effort is part of GAR’s yield intensification programme that aims to sustain long-term growth from its existing plantation area.

Fruit yield in the second half of the year grew by 20 per cent to 10.6 tonnes, bringing the full year yield to 19.7 tonnes per hectare. Total output dipped slightly to 2.94 million tonnes in 2023 from 3.06 million tonnes in the previous year, as a result of the replanting effort and high rainfall in early 2023.

Increased output contributed to 19 per cent segmental EBITDA growth in the second half compared to the first half of the year, delivering full year EBITDA of US$478 million, with a margin of 23.8 per cent.

Palm, laurics and others

GAR’s downstream segment consists of the processing and global merchandising of palm and oilseed-based products comprising bulk and branded products, oleochemicals, sugar and other vegetable oils.

Downstream sales volume expanded strongly by 12 per cent to 10.9 million tonnes in 2023, generating US$9.6 billion of revenue. However, lower selling prices in line with CPO price trend led to a 15 per cent decline in revenue compared to 2022. GAR’s focus on optimising value extraction along the operational chain has maintained downstream’s strong contribution of 51 per cent to the Company’s consolidated EBITDA. Segmental EBITDA for the full year 2023 reached US$507 million with a robust margin of 5.3 per cent.

ONGOING SUSTAINABILITY INITIATIVES

GAR’s focus on enhancing and expanding sustainability initiatives aims to meet the growing demand for sustainable products while navigating regulatory changes to future-proof the business.

GAR has achieved 99 per cent Traceability to the Plantation (TTP) for its palm production and supply chain in Indonesia, and is working to Traceability to the Mill (TTM) for its global palm supply chain outside of Indonesia. These initiatives underpin GAR’s supply chain transformation efforts, enhancing sustainable practices and verifying compliance with No Deforestation, No Peat and No Exploitation (NDPE) commitments. It will also help GAR to maintain progress towards compliance with incoming regulations such as the EU Deforestation Regulation (EUDR).

Even though El Niño conditions have subsided, the Company remains vigilant against fire and haze risk into 2024. GAR continues to harness the GeoSMART app to enhance the speed and accuracy of fire detection and will continue its rigorous capacity-building programme to help local communities prevent and fight fires. 117 villages in and around GAR’s concession areas currently receive education, equipment and early-warning systems to tackle fires risk through the Desa Makmur Peduli Api initiative.

About Golden Agri-Resources Ltd (GAR)

GAR is a leading fully-integrated agribusiness company. In Indonesia, it manages oil palm plantation area of 532,176 hectares (including plasma smallholders) as of 31 December 2023. It has integrated operations focused on the technology-driven production and distribution of extensive portfolio of palm-based products throughout its established international marketing network.

Founded in 1996, GAR was listed on the Singapore Exchange in 1999 and has a market capitalisation of US$2.5 billion as of 31 December 2023. Flambo International Limited, an investment company, is GAR’s largest shareholder, with a 50.56 percent stake. In addition, GAR’s subsidiary, PT SMART Tbk was listed on the Indonesia Stock Exchange in 1992.

As an integrated agribusiness, GAR delivers an efficient end-to-end supply chain, from responsible production to global delivery. In Indonesia, its primary activities include cultivating and harvesting oil palm trees; the processing of fresh fruit bunch into crude palm oil (CPO) and palm kernel; refining CPO into value-added products such as cooking oil, margarine, shortening, biodiesel and oleo-chemicals; as well as merchandising palm products globally.

GAR’s products are delivered to a diversified customer base in over 100 countries through its global distribution network with shipping and logistics capabilities, destination marketing, on-shore refining and ex-tank operations. GAR also has complementary businesses such as soybean-based products in China, sunflower-based products in India, and sugar businesses.

View original content to download multimedia:https://www.prnewswire.com/apac/news-releases/continued-focus-on-optimising-margins-across-the-value-chain-underpins-solid-performance-for-golden-agri-302073536.html

SOURCE Golden Agri-Resources